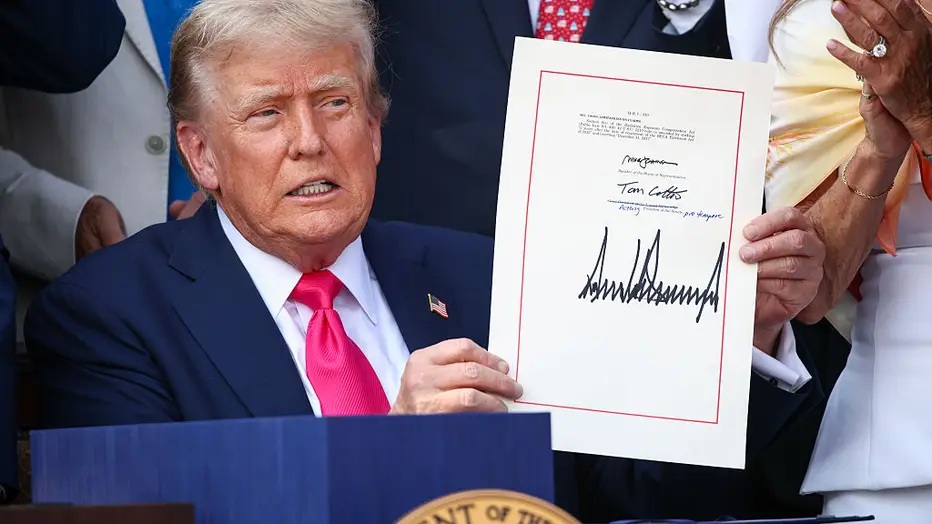

Donald Trump Approves Law Making Tips Exempt from Taxes

On July 4, 2025, President Donald Trump signed the One Big Beautiful Bill Act into law, marking one of the most significant overhauls of the federal tax code in decades.

The legislation, which spans over 1,200 pages, represents a comprehensive attempt to reshape the tax landscape for millions of Americans.

Supporters hail it as a landmark achievement that provides immediate financial relief to working families, seniors, and small business owners, while critics warn of the potential long-term consequences, projecting that the bill could increase the federal deficit by as much as $3.4 trillion over the next ten years.

At the heart of the law is a permanent extension of several key tax cuts originally enacted in prior legislation. These cuts reduce marginal rates for individual taxpayers, effectively allowing Americans to retain a larger portion of their earnings each year.

Additionally, the bill introduces new provisions aimed at improving the financial situation of specific groups. Among the most notable changes is the permanent exemption of tips from federal income tax.

This provision directly affects millions of service industry workers, including restaurant staff, bartenders, hotel employees, ride-share drivers, and delivery personnel. While tips must still be reported for recordkeeping purposes, they are no longer subject to federal income taxation, providing workers with immediate increases in take-home pay.

In addition to tip exemptions, the bill includes a range of targeted measures designed to assist seniors, workers who regularly log overtime, and small business employees.

Tax-free overtime pay is now codified into federal law, ensuring that employees who work extra hours do not face additional tax burdens on that income.

Expanded deductions for seniors are also included, allowing retirees to claim greater tax relief on medical expenses, property taxes, and certain qualifying charitable contributions

By combining these provisions, the bill aims to offer a multi-layered approach to tax relief, targeting both immediate financial needs and broader structural support.

Proponents argue that these changes are particularly beneficial to financially vulnerable workers. Many service industry employees operate on slim margins, often living paycheck to paycheck without access to comprehensive benefits. Senator Ted Cruz, one of the primary sponsors of the bill, emphasized this point during a press conference, stating, “These workers deserve to keep more of what they earn.

By removing the federal tax on tips, we are ensuring that hardworking Americans can see the rewards of their labor without unnecessary deductions.” Senator Jacky Rosen echoed these sentiments, noting that the legislation not only supports individual workers but also strengthens small businesses by increasing disposable income without requiring wage hikes.

Critics, however, caution that the legislation may create unintended consequences. The exemption for tips, while beneficial for certain groups, inherently favors those employed in the service industry over workers in sectors such as manufacturing, technology, or education.

This selective approach, opponents argue, could encourage employers to restructure compensation models to take advantage of the tax-free status of tips.

Some economists have expressed concern that these changes might exacerbate income instability, as workers may receive irregular income that is not adequately planned for in budgets or retirement savings. Furthermore, combined with the permanent extension of existing tax cuts and expanded deductions, opponents warn that the law prioritizes short-term relief over long-term fiscal responsibility.

The law’s passage also reflects a broader political philosophy emphasizing individual financial empowerment over the expansion of government programs. By reducing the tax burden and increasing take-home pay, the legislation reinforces a vision in which workers have greater control over their finances.

Supporters contend that this approach stimulates economic activity by allowing more disposable income to circulate in the economy, potentially boosting consumer spending and supporting local businesses.

This, in turn, could generate secondary economic benefits, including increased demand for goods and services, greater employment opportunities, and enhanced entrepreneurial activity.

Implementation of the law began immediately, and early indicators suggest that many Americans, particularly in the hospitality and tourism sectors, are already noticing tangible increases in their paychecks.

Restaurant servers and bartenders have reported seeing substantial rises in net income, while seniors taking advantage of expanded deductions are experiencing reductions in taxable income that make retirement finances more manageable.

Economists are closely monitoring these effects to determine whether the targeted tax breaks will generate sustained economic growth or if they will contribute further to the federal deficit.

While the law is celebrated by many for its immediate financial relief, it has sparked vigorous debate about fairness and fiscal sustainability. Opponents argue that the legislation provides disproportionate benefits to specific groups while neglecting others who also face economic challenges.

For instance, salaried employees who do not receive tips may not see any meaningful benefit from the new provisions, potentially widening existing income disparities.

Additionally, some analysts caution that the $3.4 trillion projected increase in the deficit could have long-term consequences for interest rates, federal borrowing, and funding for critical programs such as Social Security and Medicare.

The political implications of the bill are also significant. Supporters view it as a tangible fulfillment of campaign promises to prioritize working Americans and reduce the tax burden.

For critics, however, the law symbolizes a focus on short-term political gain over sound economic planning. Congressional leaders have noted that while the law provides immediate relief to millions, future policymakers will face difficult choices regarding deficit management, spending priorities, and potential adjustments to taxation policies.

The exemption of tips, in particular, has ignited debates within both policy and public spheres. Advocates argue that service industry workers, who often rely on tips as a significant portion of their income, deserve this relief, and the provision helps close the gap between low wages and living expenses.

Critics, however, warn that the change may incentivize employers to adjust wage structures in ways that could create inequities or further pressure tipped employees to rely on inconsistent income. These discussions have been amplified through media coverage, town hall meetings, and social media, fueling a national conversation about income, fairness, and economic policy.

The economic impact of the One Big Beautiful Bill Act is already being felt across the United States, particularly in the service, hospitality, and tourism industries.

Employees who rely on tips as a primary source of income are reporting immediate increases in their take-home pay, leading to higher morale and increased consumer confidence. Restaurant owners, hotel managers, and small business operators have noted that employees are less stressed about meeting monthly expenses, allowing them to focus more on customer service and productivity.

Some small businesses have even reported a slight increase in hiring as workers feel more financially secure, potentially stimulating local economies.