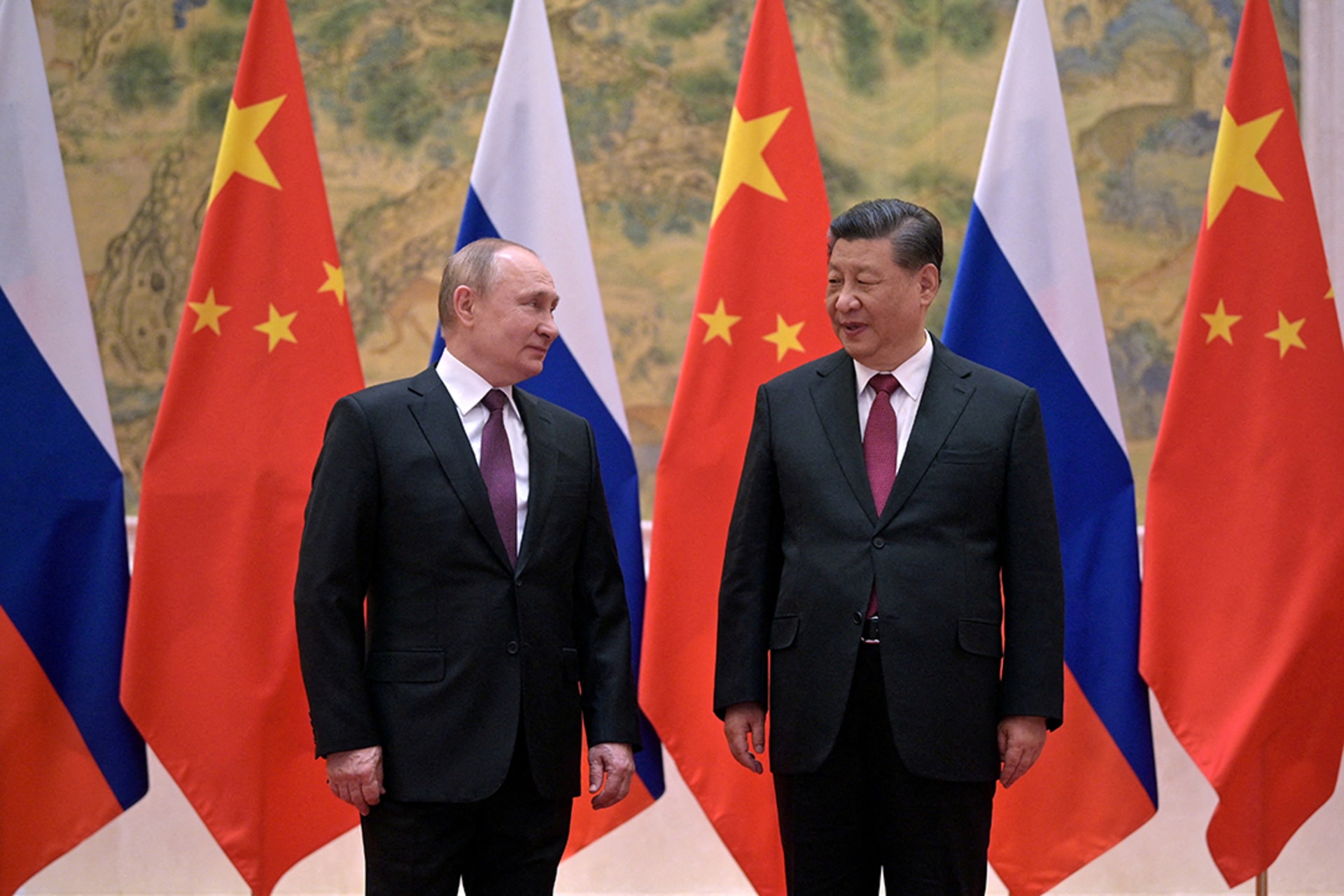

Russia and China Expand Energy Cooperation, Raising Concerns Over Global Economic Impact

Russia and China have taken steps to deepen their energy cooperation, particularly in oil trade, a move that analysts say could have significant implications for global markets and U.S. economic stability.

In recent months, Moscow and Beijing have increased bilateral oil transactions, often conducted outside traditional dollar-based payment systems. The shift comes amid ongoing geopolitical tensions, Western sanctions on Russia, and China’s efforts to secure long-term energy supplies at discounted prices.

According to energy market observers, Russia has redirected a substantial portion of its oil exports toward China following restrictions imposed by the United States and its allies. China, now one of Russia’s largest energy buyers, has benefited from lower prices while strengthening its strategic partnership with Moscow.

Some commentators argue that the growing use of alternative currencies in oil transactions could weaken the global dominance of the U.S. dollar over time. The dollar has long been the primary currency for international energy trade, a position that has helped support U.S. financial influence worldwide.

However, economists caution that claims of an imminent collapse of the U.S. economy may be overstated. While rising energy costs, inflationary pressures, and high national debt remain concerns, the U.S. economy continues to show resilience through strong consumer spending, a large domestic market, and diversified energy production.

“The expansion of Russia–China energy ties is significant, but it does not automatically translate into immediate economic collapse for the United States,” said one market analyst. “Global energy markets are complex, and shifts of this scale typically play out over many years.”

U.S. officials have acknowledged the challenges posed by closer coordination between Russia and China but maintain that domestic energy production and international partnerships help mitigate risks. The United States remains one of the world’s largest oil producers and exporters, providing a buffer against external supply shocks.

Meanwhile, global oil markets are closely watching how these developments may affect prices, supply chains, and geopolitical alignments. Any sustained disruption or reconfiguration of energy trade could influence inflation, trade balances, and economic growth across multiple regions.

As Russia and China continue to strengthen economic ties, analysts say the long-term impact will depend on how quickly alternative trading systems expand and how major economies respond. For now, experts emphasize caution, noting that while strategic shifts are underway, their full economic consequences have yet to be realized.